The financial services industry has strict security and privacy related regulations that can create challenges when an institution is trying to implement changes and innovate. Despite the regulations, many incremental adjustments have been made over the years to adapt to how consumers transact and invest digitally. The question remains, is the industry moving fast enough?

Just like we have observed with other industries, the coronavirus pandemic has accelerated certain trends. Over the course of the year, many facets of the industry have been affected by the pandemic, including postponed tax filing deadlines, banks offering credit relief measures, increased mortgage refinancing amid lower interest rates, and an increase in digital stock market investments. Such changes have put more pressure on banks to accelerate the release and adoption of their digital initiatives to keep up with consumer trends and behaviours.

Consumers have been overwhelmed this year, spending less and saving more—especially as they reassess their personal finances to prepare themselves financially for the present and the future. Banks have seen higher cash balances this year, and an increased interest in the stock market, indicating that more people are mindful of their discretionary spending and saving their money. In this post, we will hone in on consumer trends that have emerged, focusing on the consumer banking sector, and identify how these may also affect digital advertising strategies.

Emerging Trends Affecting Consumer Banking

With improvements already made to adapt to consumer trends over the years, banks have been able to quickly pivot to a digitally-dominant workflow, both on the front-end (client-facing) and backend (operations).

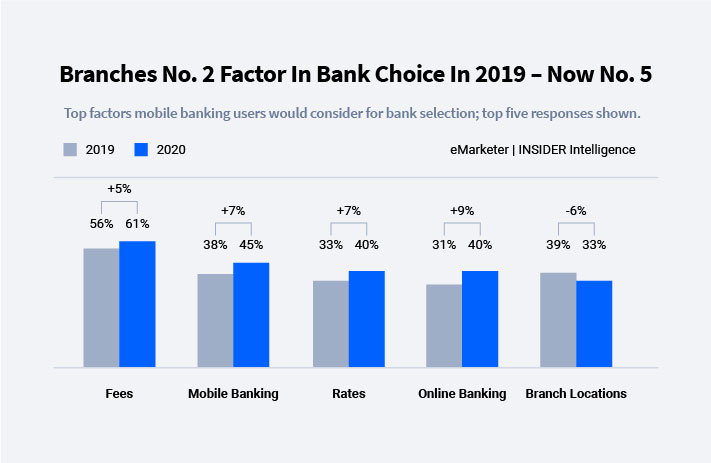

Retail Banks: In recent years, banks have been undergoing a slow branch transformation, reducing the number of branches and encouraging consumers to go online for their everyday banking from viewing their financial statements, making payments and accessing live chat functionalities for online assistance. Today, with social distancing and government-mandated stay-at-home measures in place, these functions have become a necessity. With current reduced branch hours, and a limit to the number of visitors at physical locations, consumers have found the online options more accomodating. We continue to observe a trend with branches decreasing and the reconfiguring of branch roles to meet the new customer behaviours.

Online Banking: With the current limitations of in-branch visits, there has unsurprisingly been a decline in in-person meetings with advisors and bank tellers. Older demographics have found themselves more immersed in digital than ever before, whether they were ready for it or not. With more services now available online, the adoption rate for online banking has increased significantly, as illustrated in the graph below. This trend will likely stick around as consumers become more familiar with real-time account updates and the convenience of accessing their data in the comfort of their homes.

Banknotes: There have been concerns about whether banknotes play a role in spreading the virus. As a result, consumers have decreased their cash payment methods, being forced to transact via plastic cards or a digital wallet, and some retailers now refuse to accept cash payments. Despite this, 85% of participants in a FIS survey would still prefer cash payment, indicating that cash payments are not likely to disappear just yet.

Mobile Payment: Mobile payments are becoming more popular. Millennials have been the key demographic in adopting mobile payment options, which offers a fast and easy way to transact. Given the millennial generation’s aptitude to use technology, they have been turning to their smartphones as the preferred tool for making online payments—given the convenience when compared to other methods of payment, like cash.

3 Key Programmatic Solutions to Reinforce Consumer Trust

Many financial services institutions have been focusing on direct response advertising. In fact, financial companies are forecasted to be the 2nd largest ad spenders behind retail. For example, with tax filing deadlines extended, H&R Block has ramped up its advertising efforts spending more time advertising and increasing their efforts. With the increased interest in investing, it’s no surprise that online investment platforms are now advertising heavily as well. These companies are leveraging direct response as a way to generate leads, build trust, customer engagement, increase satisfaction and, ultimately, customer lifetime value. Let’s take a look at how programmatic plays a role.

1. Leverage 1st-Party Data to Nurture Your Audience Through Native

The pandemic has really put a magnifying glass on how companies communicate and position themselves in the marketplace. Seventeen percent of consumers surveyed in a PwC report stated “their non-primary banks did a better job supporting them during COVID-19”—making it very critical to build trust and to be transparent in your communications. In times of uncertainty, it is important to invest in initiatives that will differentiate you from your competitors.

Native ads enable a more candid conversation with users. They help advertisers to appropriately amplify content that will prove useful for those conducting research and trying to gain a better understanding of a topic. With a native campaign, you can inform your target audience of the changes your bank is experiencing or amplify any content that teaches your clients how to manage personal finances amid economic challenges. By empathizing with your clients and letting them know they are not alone, you will be able to build their trust. And the best way to reach your clients and prospects is with 1st-party data. Many industries have a plethora of customer lists and repositories of prospects that can be a valuable target audience—so leverage it! Upload your 1st-party data to connect with your clients through native ads.

2. Customer Enablement Through Video Content

Nurturing, educating and preparing your existing customers for the ‘new normal’ can help you retain clients. Many generational adopters have emerged. As noted in a previous post, baby boomers have increased their time spent digitally. Empowering them through education on how to use your online banking platform can be very valuable and can increase long term adoption rates. Just because it may seem intuitive to you doesn’t mean it may be to your customers!

Although millennials have a much higher rate of digital literacy, they are constantly looking for ways to improve their overall financial health and efficiency. They are also a demographic known to have high credit card and student loan debts. So during times of uncertainty they are looking for financial advice.

Creating content such as informational videos can help educate your audience on their financial options. Videos that explain possible solutions to the different challenges can go a long way, especially when in-person financial advisor meetings are limited. A video acts as a placeholder for in-person conversations.

Video ads if used effectively can put your audience in a position where they feel empowered by the knowledge gained to make sound financial decisions.

3. Harness Moments Through A Contextual Always-On Strategy

Finding moments when people are in the market for your product is pivotal for the financial service industry. Consumers do not frequently change banking providers, unless they are unsatisfied with the service or are in search of promotions. In fact, according to Statista, 54% of US consumers are fully satisfied with their current bank. Therefore, having an always-on upper-funnel strategy can keep your brand top of mind and capture the moments when the consumer is in-market to ‘shop’ around for a new bank.

You can find those consumers who are actively reading content about different product offerings with custom segments. In today’s current climate, it is key to constantly reassess the creative messaging you are using in your campaigns. Having personalized messaging according to the content they are searching for can have an impact on helping consumers through relevant challenges. Personalized and timely messages will differentiate you from the crowd and leave a memorable impression.

As the finance service industry rapidly adjusts to the need for online alternatives for all its offerings, leveraging a holistic programmatic campaign can benefit your overall digital strategy.

As we wrap up our latest trends and insights blog series for 2020, we hope you have found it insightful and are able to apply some of these strategies in your upcoming 2021 marketing plans. If you have missed the previous trends and insights, here they are for quick reference:

- A Look at 2020 and Beyond: How Trends and Insights are Reshaping Industries

- How Trends and Insights are Reshaping the Automotive Industry

- How Trends and Insights are Reshaping the Real Estate Industry

Want to run exceptional programmatic campaigns? Request a demo to learn more about StackAdapt.