StackAdapt Cookie Notice

-

5 Tips for Planning Back to School Campaigns in 2024

With summer just around the corner, it’s the perfect time for digital marketers to start planning their back to school campaigns for 2024…. -

4 Ways to Leverage Digital Marketing for Father’s Day

Father’s Day recognizes fathers, fatherhood, and father figures. For millions of caregivers around the world, it’s time for family gatherings, gifts, special outings,… -

12 Programmatic Features for Political Campaign Advertising

Creating a successful political ad campaign starts with drawing insights from past election cycles. The 2020 US political cycle turned out to be… -

Why Healthcare Marketers Should Leverage CTV Advertising

In recent years, the relevance of connected TV (CTV) advertising has been growing. In 2023, 88% of US households -

Score a Touchdown With These Super Bowl Campaign Tips

The Super Bowl attracts some of the largest TV audiences in North America. In 2023, the Super Bowl game between the Kansas City… -

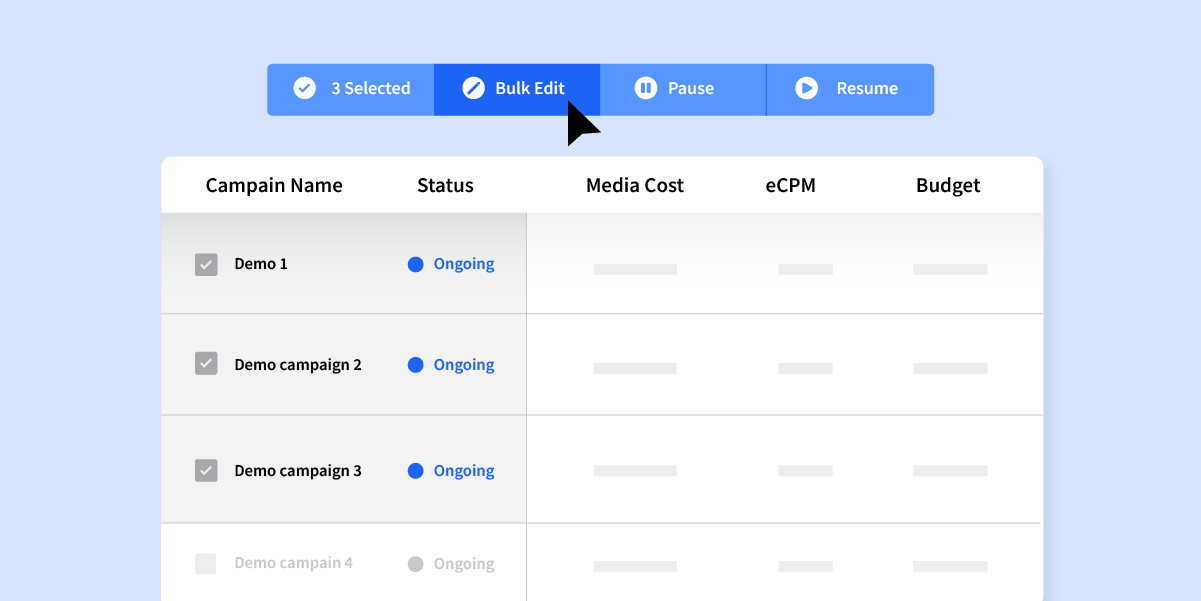

Improve Your Programmatic Campaign Productivity With Bulk Edit

In programmatic advertising, time matters. Whether it is related to the timeliness of the campaign concept, campaign reporting, or optimizations, the… -

6 Ways to Win at B2B Audience Targeting

B2B marketing is increasingly digital. According to eMarketer, digital ads will comprise nearly 50% of all B2B ad spending… -

Healthcare Digital Marketing: How to Find Your Audience

Healthcare marketers need to be aware of the many rules and regulations that exist within the healthcare digital marketing industry. With a ton… -

8 Must-Know Tips For Retail Advertising

The retail industry is always evolving thanks to changing consumer trends and advancements in technology. For example, back in 2013, online sales of… -

3 Strategies For Building Lookalike Audiences From Holiday Traffic

Following the trends of the last few years, it’s expected that this holiday shopping season will last longer and be driven by e-commerce….