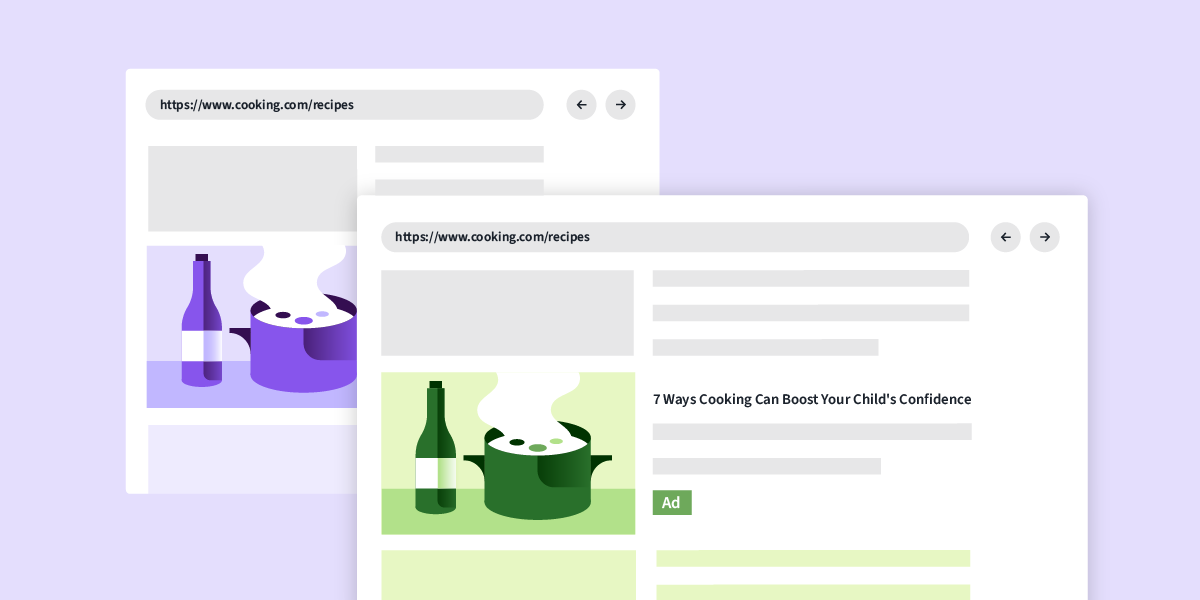

In a digital-first, cross-device world, native advertising belongs in every marketer’s media mix. Native advertising matches the look, form, and feel of the media format that they appear in. Unlike banner or display ads, native ads don’t really look like ads, especially at first glance. They perfectly blend into the content that a user is viewing online.

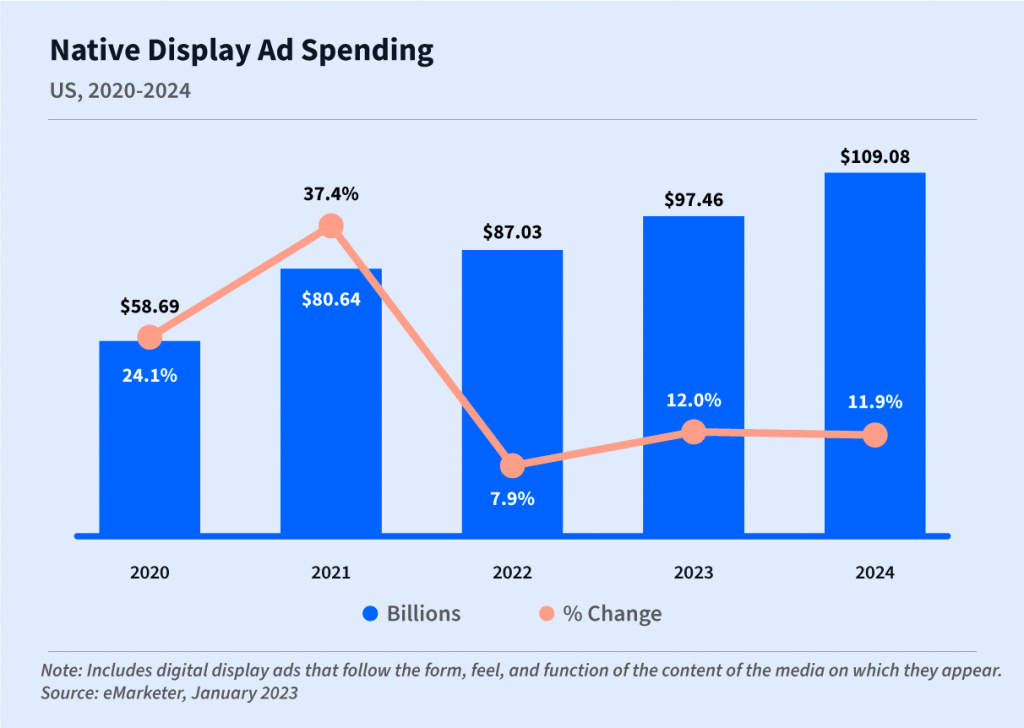

This programmatic channel combines customized native content with the power of programmatic technology. Native advertising is highly scalable, and it’s beneficial to add to a multi-channel strategy. This is likely why native display ad spend has been steadily increasing in the US. It’s projected that spending will reach $109 billion USD by 2024.

The Benefits of Native Advertising

Here are 8 reasons to use native advertising in your next digital campaign:

1. Higher Click-Through Rates

Native advertising can produce a high click-through rate (CTR) because ads are tailored to match their surrounding content and context. As a result, native ads fit into the user journey instead of interrupting it.

To achieve high CTRs with native ads, the key is to ensure the native ad content adds value to the user’s experience. Native ads are meant to seamlessly blend in, rather than disrupt a user’s page experience.

Regardless of whether your native advertising campaign goal is to build an audience or drive an action, the first step is to have an engaging piece of content for users to click through to.

2. Cost Efficient

Particularly when you compare native ads vs. display ads, native advertising is much more cost-efficient. This is because the CTR is likely higher. Since ads are typically purchased on a cost per thousand (CPM) basis, the higher CTRs can drive down your cost per click (CPC). With conversion rates held equal, the cost per action, whether it’s getting the user to spend time on the content or to complete a form, will also be lower.

3. Sophisticated Targeting

Another one of the important reasons to use native advertising is the sophisticated targeting capabilities of programmatic. Your ad spend isn’t wasted because you’re able to target the right audiences for your messaging.

Native advertising allows for various types of targeting, including contextual targeting, demographic targeting, location-based, device-based, or intent-based targeting. Users will always prefer ads tailored to their interests and shopping habits, and so personalized targeting through programmatic native advertising is key to winning new customers.

4. Non-Disruptive Ads

Native ads are non-disruptive because they act as an extension of the browsing experience. By fitting the form and function of a given webpage, native advertising fits seamlessly into the browsing behaviour of the average web user, making them more likely to take interest in your content.

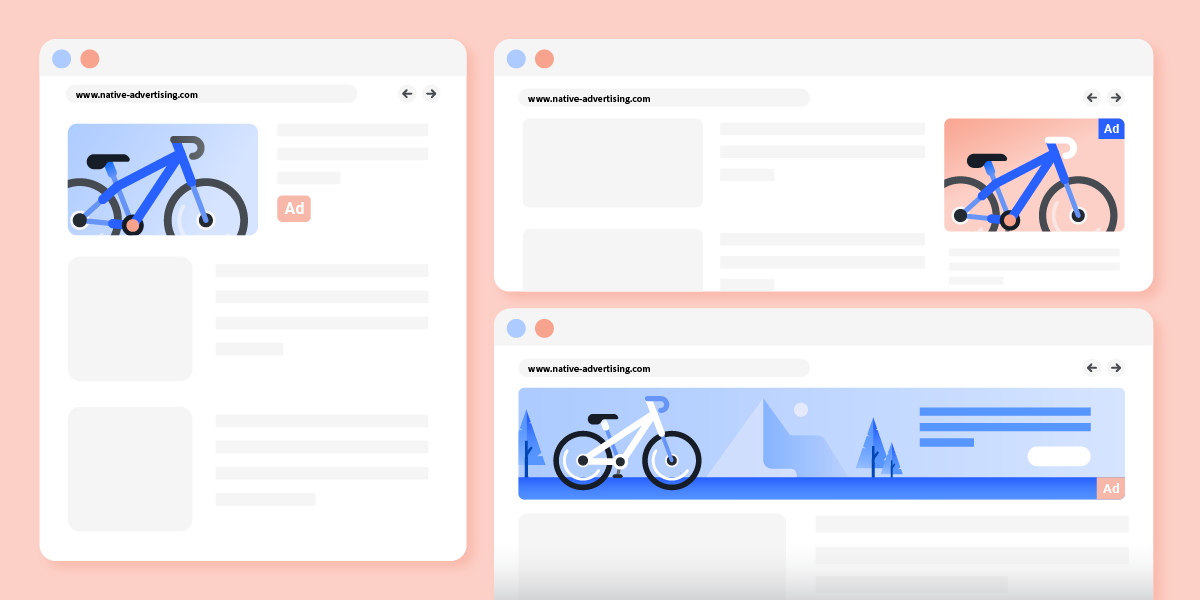

5. Various Native Ad Formats

The term native advertising is broad and it’s always evolving. When this ad format first emerged, it was seen as a modern version of the advertorial. But today, it’s considered to be a separate channel designed to deliver high-quality, value-adding branded content..

This channel is versatile because there are various native ad formats that marketers can choose from. Below are three categories of native ads that you can leverage in your programmatic campaigns.

In-Feed Native Advertising

In-feed native advertising is the most common form of native ads thanks to its “mobile-first” approach and ability to drive users to advertisers’ owned-media properties. It includes promoted listings and paid results.

In-Ad Native Advertising

If you’re using StackAdapt, you can leverage in-ad native. This format uses the elements of a native ad, including image, headline, body, and brand logo. In-ad native ads appear within the display inventory of a given page. You can achieve greater reach while using elements that make native ads so engaging, when native inventory is limited.

Content Recommendation Widgets

Content discovery widgets are typically found at the bottom of a web article. Typically considered a means for publishers to drive traffic and monetize their content, some marketers see value in reaching a wide audience in a cost-effective manner through content recommendation.

6. Increased Brand Loyalty

Native advertising presents a unique opportunity to share your brand story. The combination of imagery, headline, and description allows advertisers to succinctly state their message, represent their target demographic, and even give extra information on the benefits, values, and story behind the product or service. Beyond the ad, the click-through content presents the opportunity to push the message even further.

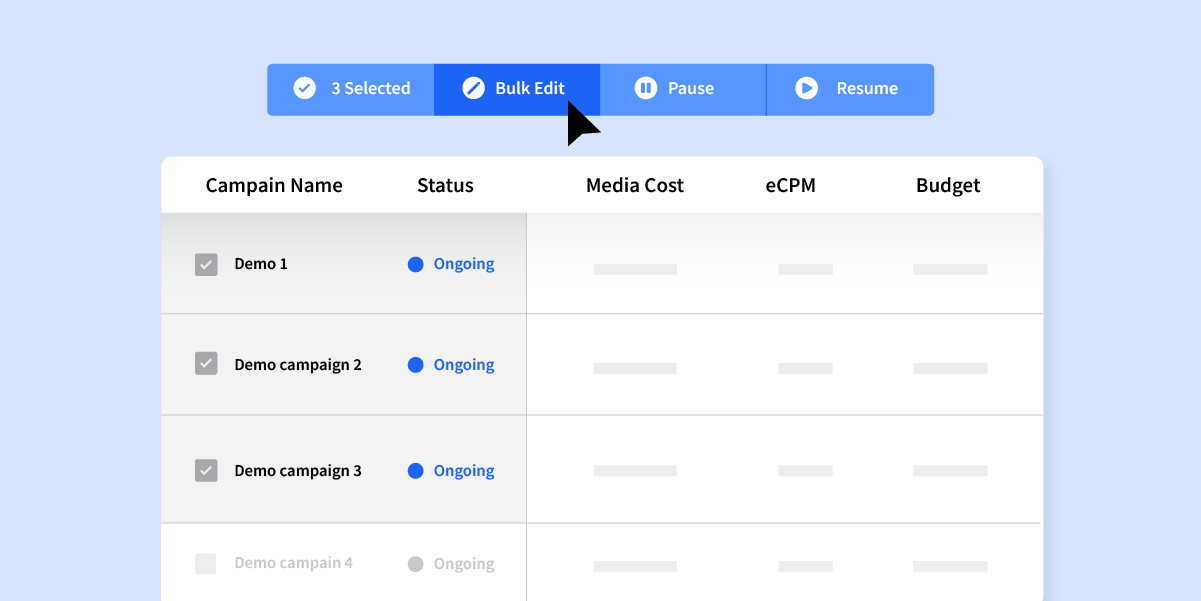

7. Campaign Reporting

Since native advertising is powered by programmatic, it comes with detailed campaign reporting. You have the ability to track campaign metrics that are most important to you. When programmatic campaign reporting is set up effectively, it will provide you with insights that are necessary to drive increased performance. Metrics can be pulled from campaign results, and then used to help you narrow down who, when, and where to target in your future campaigns.

8. Great For Multi-Channel Campaigns

This might be one of the absolute most important reasons to use native advertising. It’s the perfect channel to use as part of a multi-channel campaign. A multi-channel strategy enables you to reach consumers throughout the entire funnel.

The goal of this strategy is to create a cohesive story across various programmatic channels like video, connected TV (CTV), and audio. Native advertising is the perfect channel to add to your multi-channel campaign because it will help to increase the percentage of the total target audience that you can reach, and it helps you to craft a brand story throughout the entire customer journey.

Get Started With Native Advertising

The best way to use native ads is to use them to educate your target audience. They align with content and blog posts in the way they are formatted, and so they can be used to deliver information and answers that your audience might be looking for.

Want to run exceptional programmatic campaigns? Request a demo to learn more about StackAdapt.